Things Young Investors Say That Sound Intelligent (But Are Not)

- Akshay Nayak

- Oct 31, 2025

- 5 min read

The past five years have seen a number of young Indian individuals enter the financial markets. Today such investors would have a basic understanding of the way financial markets and instruments work. This experience is often enough to give them the confidence to mouth certain statements. These statements may make them sound intelligent. But very often, young investors make such statements without understanding the gravity and truth behind them. Therefore today I will look at a few such statements that young investors make. I will then examine the truth behind them. This would show why young investors may not be able to back their words up with their actions.

I Have A High Risk Appetite

This is usually said by young investors because they believe that age and risk appetite are inversely proportional. In other words : lower the age, higher the risk appetite. But age is not the only factor that decides risk appetite. Risk appetite is best understood only in hindsight. This is because risk appetite is largely based on the behaviour of the investor. And behaviour can only be understood through observation over a period of time.

Also, the term 'high risk appetite' is subjective and hard to define. Risk awareness is a much better guage of risk appetite. Risk awareness broadly shows how well an investor perceives and understands the risks associated with an investment product. A higher degree of risk awareness may be linked to a higher risk appetite. But risk awareness increases only through experience over multiple market cycles. Young investors of today are unlikely to have the requisite degree of experience. They must therefore refrain from stating or implying that they have a high risk appetite.

A Significant Allocation To Mid And Small Caps Will Boost My Returns

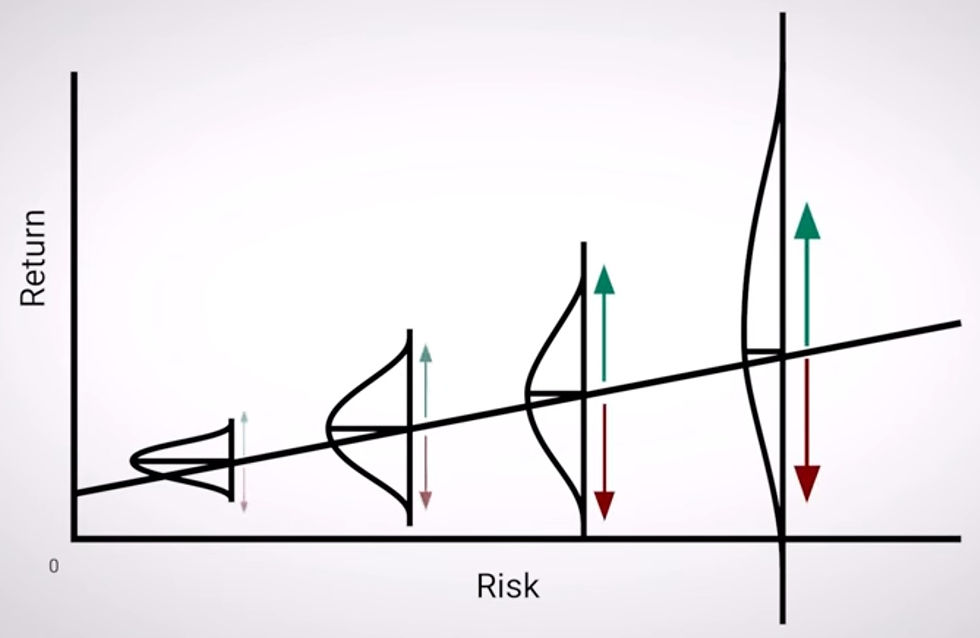

The belief behind this statement comes from the general perception of the relationship between risk and return. Taking greater risks is perceived to translate into greater returns. This relationship can be represented graphically as shown in the graphic below. The horizontal axis represents the degree of risk taken over time. The vertical axis represents the return earned over a period of time.

The upward sloping line implies a positive and linear relationship between risk and return. But such an understanding of the relationship between risk and return is completely flawed. This is because if investing in riskier assets meant getting a higher return, there would essentially be no risk. There is a more mature way to understand the relationship between risk and return. Some investments offer a higher expected return than others. But the actual return delivered may be lower than than the expected return. And that is where the risk comes from.

Understanding the relationship between risk and return in terms of events and possible outcomes is also important. The range of possible outcomes for an event can typically be represented using a bell-shaped curve (normal distribution). Positive outcomes fall on the right side of the bell-shaped curve, and negative outcomes fall on the left side. When the bell-shaped curve pertaining to a particular event is superimposed on the risk-return graph given above, we get the resultant graph, as shown below.

Notice that as we move higher on the risk-return line, the width of the base of the bell-shaped curve increases. This implies a wider range of possible outcomes to an event over longer time horizons. It also indicates that the positive outcomes to an event are progressively more rewarding over time. This is reflected by the increasing length of the green line to the right of each bell curve. It also indicates that the negative outcomes to an event are progressively more severe over time. This is reflected by the increasing length of the red line to the left of each bell curve. So our chances of earning a positive return are better over longer time horizons. But the range and severity of risks we are exposed to are also greater. And that is where the risk comes from for investors.

Long term investing in mid and small caps works the same way. When they do well, they may generate exponential returns. But when they crash, they can decimate a portfolio. Phases of stagnation in mid and small caps can last for years. So young investors must ask themselves whether they are willing to live with these unsavoury aspects of mid and small cap investing. An honest introspection would lead to an answer in the negative for most such investors.

I Will Hold My Nerve During A Market Crash

This statement may seem like a display of confidence. But it is actually nothing more than a defense mechanism. Such statements are usually used to defend the decision of having a disproportionate allocation to risky assets like equity. Young investors argue that because they have a long time horizon they don't have to worry about a crash. This is because they can allow time for the markets to recover. But in saying this they completely disregard the psychological aspects of investing.

Most young investors today have not yet lived through a genuine market crash. Investors who lived through the COVID downturn of 2020 point to that fact as proof that they can handle a market crash. But in hindsight, the COVID downturn was not a genuine market crash. It was only a steep correction. This is because the recovery post the correction was almost as swift as the correction itself.

A genuine market crash begins with a steep fall. But crucially, this is followed by a prolonged period of stagnation that lasts a few years. This is akin to what we saw during the Global Financial Crisis in 2008. The market crashed in 2008 and remained stagnant between 2009 and 2013. Young investors of today would likely lack the psychological fortitude to continue investing through such a period. So they would likely need to eat their words about being able to handle a market crash.

Young investors must therefore first show the discipline to continue investing through a crash. Only then should they make such claims about being able to handle crashes.

I Am Adding This Product / Asset Class For Diversification

Young investors usually say this when they add or wish to add a new product or asset class to their portfolios. Most young investors today may wish to add commodities or international equity to their portfolios. But they must realise that mere addition of asset classes to a portfolio is not diversification. Diversification is not aimed at increasing portfolio returns. It is aimed at reducing portfolio risk.

Young investors must therefore understand whether adding a particular asset class would meaningfully reduce risk in the portfolio. For instance adding a 10% allocation to gold may not meaningfully reduce the impact of a 50% crash in equity on the portfolio. It would also offer little in terms of incremental returns (if any). Moreover addition of asset classes makes managing the portfolio more complex.

Allocations to various asset classes in the portfolio change over time. Rebalancing portfolios becomes more complex as the number of asset classes in the portfolio increase. It may also increase the tax liability for the investor. Young investors must therefore ask themselves whether they can handle this before adding an asset class to their portfolios. Most young investors would find that the job is too complex for their liking. They must therefore refrain from blindly adding asset classes to their portfolios.

Final Takeaways

Each of these statements may give the impression that the investor knows what they are doing. But a look at the implications of most of these statements would show that there are a number of nuances and demands attached to them. And investors would mostly find that they are incapable of meeting them. Even if they are met, it would only make their money management more complex. Therefore young investors must not mouth such statements without understanding them first

Comments