Going For Gold

- Akshay Nayak

- May 23, 2025

- 3 min read

The idea of purchasing and owning gold has a special place in the mindspace of most Indians. Most of the gold owned by individuals in India is in the form of physical holdings and family heirlooms which are handed down across generations. But in the context of portfolio construction things change significantly. We must develop the right perceptions about investing in gold. Only then would we employ gold in our portfolios effectively. Therefore in today’s post I’m going to delve deep into the subject of investing in gold.

Irrelevance Of Physical Gold

We must first understand that physical gold cannot be considered an investment. Most purchases of physical gold are usually meant for personal use. This makes physical gold a consumption oriented asset, not a growth oriented investment asset. Moreover holding physical gold comes with risks such as theft, impurity and making charges. Any investment in gold must allow us to track gold prices in real time. Physical gold does not allow us to do this. We must therefore purchase physical gold only for present or future use. Therefore, when assessing portfolio exposure to gold we must only consider instruments such as gold mutual funds, gold ETFs and SGBs. Let us now look at the various avenues that enable investments in gold.

Gold Mutual Funds And ETFs

These are ideal for investors who wish to gain exposure to gold in a systematic manner. Both of these avenues broadly work with the same mechanism but have subtle differences. Any money invested in a gold ETF is used to buy 99.5% pure gold bullion. These purchases are denominated in grams. They are the reflected as ETF units in the investor's portfolio. Therefore, holding one unit of a gold ETF is equivalent to holding one gram of physical gold. On the other hand gold mutual funds invest in gold ETFs. Therefore, they use ETFs as a vehicle for gold exposure. Therefore, price movements in these two products are heavily dependent on gold prices in the physical market. Investors must have a demat account to transact gold ETFs. But there is no such compulsion when it comes to gold mutual funds.

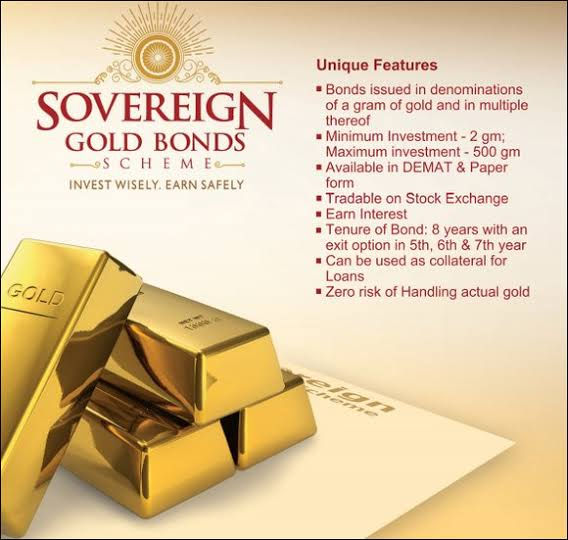

Sovereign Gold Bonds (SGBs)

These are offered by the Reserve Bank Of India at regular intervals during a particular financial year. Interested investors are given a set window within which to invest in such bonds. They come with a tenure of eight years and a lock in period of five years. Gains made on the redemption of these bonds at the end of the eight year tenure are completely free from tax. They can also be traded through stock exchanges if they are held in demat form. Also, SGBs offer investors interest at the rate of 2.5% on the initial amount invested. But it is taxable in the hands of the investor at applicable slab rates.

Therefore, these bonds are ideal for investors who wish to invest a lumpsum amount in gold. They are also ideal for those who wish to accumulate gold for a long term goal such as a child’s marriage. But the goal must be more than eight years away. They can also serve as collateral securities against which investors can avail loans. Finally, they are ideal for those who come under the lower tax brackets or fall outside the tax net completely.

Using Gold In Our Portfolios

Gold has broadly beaten inflation by about 1-2% over the long term. Therefore gold cannot be included in an investment portfolio to play the role of a wealth creator. But gold is a safe haven during an economic crisis. Also, gold enjoys a low degree of correlation with asset classes such as equity and debt. This means gold as an asset class performs relatively better during periods where equity and debt underperform. We must ensure that our exposure to gold does not exceed 10% of our overall portfolios. Any returns from returns from our gold component must be treated as a bonus.

But it must be mentioned that gold is a peculiar asset class. It carries a level of volatility similar to equity. But the returns it offers is akin to that of a debt instrument. So the risk-return tradeoff may not be in favour of including gold. It also heightens complexity when managing and rebalancing the portfolio.

The Last Word

Purchasing and accumalating gold for personal use is different from investing in gold. Long term returns from gold as an asset class are inflation linked (inflation +1-2%) at best. It would therefore be most useful as a safety net during an economic crisis. It would also add another level of diversification at the asset class level. So gold is best employed within our portfolios as a wealth protector and not a wealth creator. Therefore, we must moderate return expectations from gold. Any returns from gold must be treated as a bonus.

Comments