Diligence Pays Dividends

- Akshay Nayak

- Feb 4, 2024

- 5 min read

Today, most of us use a wide variety of financial products. Right from traditional bank accounts, to stocks, mutual funds insurance policies and so on. And the fact that we use these products also means that we must educate ourselves about them. While a general understanding of the information available on a particular product is definitely a must, that alone is not enough. The most important mistakes we make with the financial products we own and use happen at point in time when we purchase them. This is because we usually do not ask the right questions about the products we buy, before we buy them. The key issue here is a lack of awareness on our parts as buyers.

This usually leads to two consequences. We end up buying products that are nowhere close to being well suited to our needs. When we realise this, we almost always find that there is no way to exit these products. And on the rare occasion that there is a way out, it is likely to be highly tedious and costly. This represents a classic case of Caveat Emptor, which is a legal principle stating that when a product is transacted, it is the responsibility of the buyer to conduct adequate due diligence and have a consummate understanding of the product before buying it. This means that the seller cannot be held liable or be asked to compensate for a lack of awareness about the product on the buyer's part.

Therefore today I will put forth a series of action points we must ideally carry out before purchasing any financial product, so as to avoid the dire consequences that may arise as a result of a lack of due diligence before we make the purchase.

Before buying a financial product, we must ask whether we are buying a product because we truly understand the product and its suitability of the way it is advertised to us. This is especially true in case of products such as insurance and mutual funds that are sold to us through intermediaries. In most cases, we end up buying such products on the back of what the seller tells us about the product. And if the one making the pitch happens to be a charming member of the opposite sex, the likelihood of our buying the pitch increases dramatically.

But pitches that sound impressive are usually fraudulent. This may take the form of the distributor or the agent painting at an overly positive picture of the product, or essential facts about the product not being disclosed by the seller. Having a clear idea of the essential nature of the products that we buy and the purposes they serve would help us test the truth of sales pitches as they are being made. And this would in turn contribute to us making informed decisions prior to going through with the purchase. So we must ensure that we buy a particular financial product based on our own knowledge of the product rather than an external party's advertisement.

When it comes to financial products, who we buy them from is just as important as what we buy. Therefore we must make sure that the intermediaries we buy our products from are adequately competent and licenced to sell the products they do. In India we have a variety of bodies that regulate financial intermediaries. Insurance Regulatory and Development Authority of India (IRDAI) for insurance agents, Reserve Bank of India (RBI) for banking professionals and Securities and Exchange Board of India (SEBI) for investment advisors to name a few for instance.

We must ensure that we only deal with intermediaries who are registered with these bodies, so that we have better assurance regarding the quality of service. This is because the regulations applicable to most of these intermediaries require them to ensure that the products they sell and the services they offer are well suited to the specific financial needs of each client. There would also be a clear trail to escalate complaints regarding these intermediaries if any. We must also clearly understand how the intermediaries we deal with are incentivised and compensated.

Ideally speaking, we must deal only with those intermediaries who are obligated to serve clients in a fiduciary capacity. In other words, the intermediaries we work with should derive their compensation solely from the clients they serve and not from any other external source such as commissions from the financial service organisations that these intermediaries represent.

Just as we ensure that the intermediaries we work with are regulated, we must ensure that the same is true for the financial products we buy. Purchasing only those products which are regulated by a particular body ensures that we would have a clear path of recourse if things were to go wrong with the products we buy. But when the products we buy do not come under the purview of regulations, any potential losses we suffer would have to be solely borne by us no matter how significant or irreversible they may be.

Take the case of the recent closure of six debt mutual fund schemes of Franklin Templeton in India for example. Because mutual funds are regulated products, the relevant regulators stepped in to ensure that all those who had money parked in those schemes which were suddenly frozen and wound up got their money back as part of a gradual process.

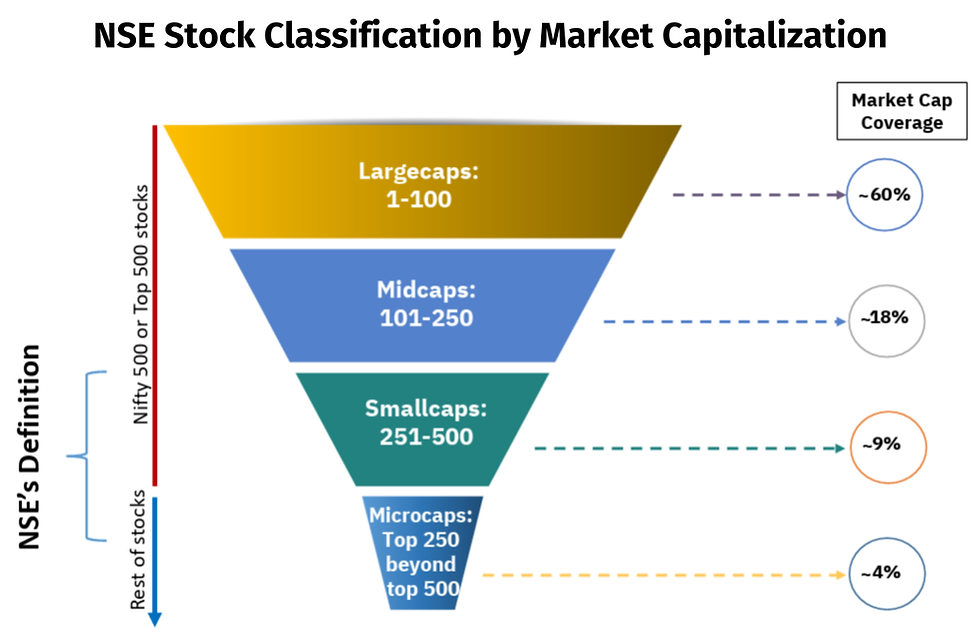

This is not true for other assets such as cryptocurrencies which are neither regulated or legalised at the present moment in India. So where investors have a problem investing in cryptocurrencies, they would be stuck with absolutely no way out. This obviously is a major risk for us as investors and therefore we must look to avoid such dubious products at all times. Every financial product that we buy comes with its own set of costs and risks as shown in the graphic that follows.

So it is only fair that we invest our time in educating ourselves about both these aspects in the case of every financial product we are looking to buy. Where we purchase the products ourselves, the onus of getting educated about these aspects would fall on our own shoulders. But where we buy our products through one or more intermediaries, we must ensure that they spend ample time educating us on the various aspects of each product before pushing us to buy them.

Carrying out adequate due diligence before purchasing financial products is therefore both a responsibility and a liability for us as investors. A little time spent carrying out adequate due diligence before making a purchase would save us a load of potential pain and stress post the purchase. It means that we would clearly know what we are getting into before we actually get into it. This would help us maintain realistic expectations from the products we buy and thus facilitate a satisfactory investment experience with each of our financial products.

Comments